how to pay late excise tax online

There is no statute of limitations for motor vehicle excise bills. Contact Us Your one-stop connection to DOR.

Online Bill Payments City Of Revere Massachusetts

Please select one of the options below.

. Winnipeg MB R3C 3M2. The purpose of the TreasurerCollectors Office is to provide secure and accurate collection of all taxes and committed bills to us by the Assessors. 2000-01 for PERIOD returns and in this format P-2001-001 for PREPAYMENT returns.

Your obligation as a taxpayer will depend on your circumstances and business type. Paying excise duty on excisable alcohol. To complete a search you must provide several pieces of information to ensure we match you to the bills in our system.

As a TTB-regulated industry member you may be responsible for paying federal excise taxes. This information will lead you to The State Attorney Generals Website concerning the Tax. A motor vehicle excise is due 30 days from the day its issued.

Get your bill in the mail before submitting online. Excise Bills are issued numerous times throughout the year when received from the Registry of Motor Vehicles and are due 30-Days after the issue dateFor Vehicles on the road January 1 that have paid an excise tax in the prior year those bills are generally issued by February 15. PAY Delinquent Excise Tax and Parking Tickets.

The tax collector must have received the payment. The excise is based on information furnished on the application for registration of the. File or amend my return.

Tax Department Call DOR Contact Tax Department at 617 887-6367. Late-filing penalties can mount up at a rate of 5 of the amount due with your return for each month that youre late. Residents who own motor vehicles have to pay taxes based on the value of their vehicles each year.

Pay your outstanding obligations online by clicking on the Green area on the home page. Excise tax return extensions. Toll-free in Massachusetts Call DOR Contact Toll-free in Massachusetts at 800 392-6089.

Form 433-F Collection Information Statement PDF. To help us process your payment correctly write your full 15-character business number BN for example 12345 6789 RC0001 on the back of the cheque or money order. If payment is not made within 30 days of the date the City issued the excise tax the Citys Collector-Treasurer will send a demand for the.

All other Excise and Other Levies payments. Depending on the circumstances the Department may grant extensions for filing an excise tax return. Online payments for excise tax are accepted only within the 30 days from the date of issue on the original tax mailed.

LICENSE OR REGISTRATION. Please use this page to search for delinquent MOTOR VEHICLE EXCISE TAX bills. 20 percent substantial understatement of net tax penalty.

2500 x 005 x 3 375. The taxes will be reported on Form 720 Quarterly Federal Excise Tax Return and Form 6627 Environmental Taxes. You must have Signing Authority TTB Form 51001 or Power of Attorney TTB Form 50008 on file with TTB to submit Federal Excise Tax Returns and.

9 am4 pm Monday through Friday. Prince Edward Island Tax Centre. You are personally liable for the excise until the it is paid off.

File by mail if you have a waiver. Welcome to the Treasurer Collectors Department. This penalty is in addition to all other penalties.

All Massachusetts residents who own and register a motor vehicle must pay the motor vehicle excise annually. Taxes and Filing. You must create a serial number in this format.

For example if you owe 2500 and are three months late the late-filing penalty would be 375. Filing frequencies due dates. View or Pay Tax bills Excise Tax Water Sewer Bills.

The Department can waive late return penalties under certain circumstances. How To Pay Late Excise Tax Online Hingham Excise Tax Fill Online Printable Fillable Blank Pdffiller How to pay your motor vehicle excise tax get your bill in the mail before submitting online pay your bill online. You pay an excise instead of a personal property tax.

Birth Marriage Death Certificates Dog Licenses. The request must be made before the due date. Publication 1854 How to Prepare a Collection Information Statement Form 433-A PDF.

MassTaxConnect Log in to file and pay taxes. Generally if you hold an excise licence you need to lodge an excise return and pay excise duty before you deliver excisable products into the Australian domestic market. Summerside PE C1N 6A2.

Plan for and pay your taxes. You have three options to pay your motor vehicle excise tax. Internal Revenue Code 4121.

Form 433-B Collection Information Statement for Businesses PDF. In this example 2000 is the calendar year covered by the excise tax return and 01 and 001 are the number of the PERIOD excise tax return filed for the year. Receive email updates Sign up for DOR news and updates.

Item 1 - Serial Number. If youre more than 60 days late the minimum penalty is 100 or 100 of the tax due with the return. Filing electronically is the fastest and most accurate way to file operational reports and excise tax returns with TTB and also provides a secure way to make excise tax payments.

Tax classifications for common business activities. Payment at this point must be made through our Deputy Collector Kelley Ryan Associates 508 473-9660. Not just mailed postmarked on or before the due date.

Then select the Municipality you wish to pay and complete the process by entering the Bill Number Tax year and Tax type which is normally EX. Online payments will have a NON-REFUNDABLE 45 convenience fee added to your total LastCompany Name. Notice 2021-66 provides an initial list of taxable chemical substances and guidance for registration with the Form 637 Application for Registration For Certain Excise Tax Activities.

100 percent late payment and late filing penalty if you dont file returns for three consecutive years by the original or extended return filing due date of the third year. Form 433-A Collection Information Statement for Wage Earners and Self-Employed Individuals PDF. We will persevere in treating all taxpayers with equity and take all necessary steps allowable by law to collect on all past due accounts.

Filing an abatement application does not excuse you from paying the excise bill. File and Pay Online. Excise Tax on Coal.

Stay current with filing frequencies and operational reports excise tax and export due dates by subscribing to receive automated reminders when it. You will generally need to pay excise duty on either a prepayment basis or a periodic settlement basis when you lodge your excise return. The city or town where the vehicle is principally garaged levies the excise and the revenues become part of the general funds of the municipality.

Please click on the Invoice Cloud PDF below for a quick guide on how to register. This is in addition to the 5 percent failure-to-pay penalty.

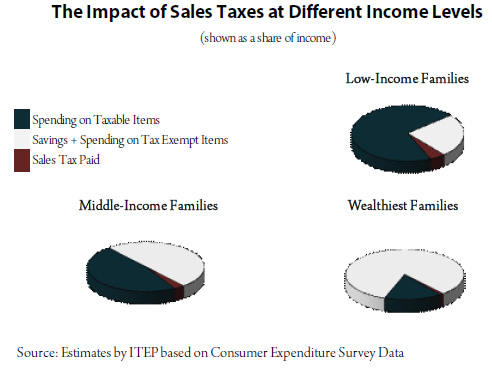

How Sales And Excise Taxes Work Itep

Corporate Excise Tax Penalties Waived S Corporation Efile Irs

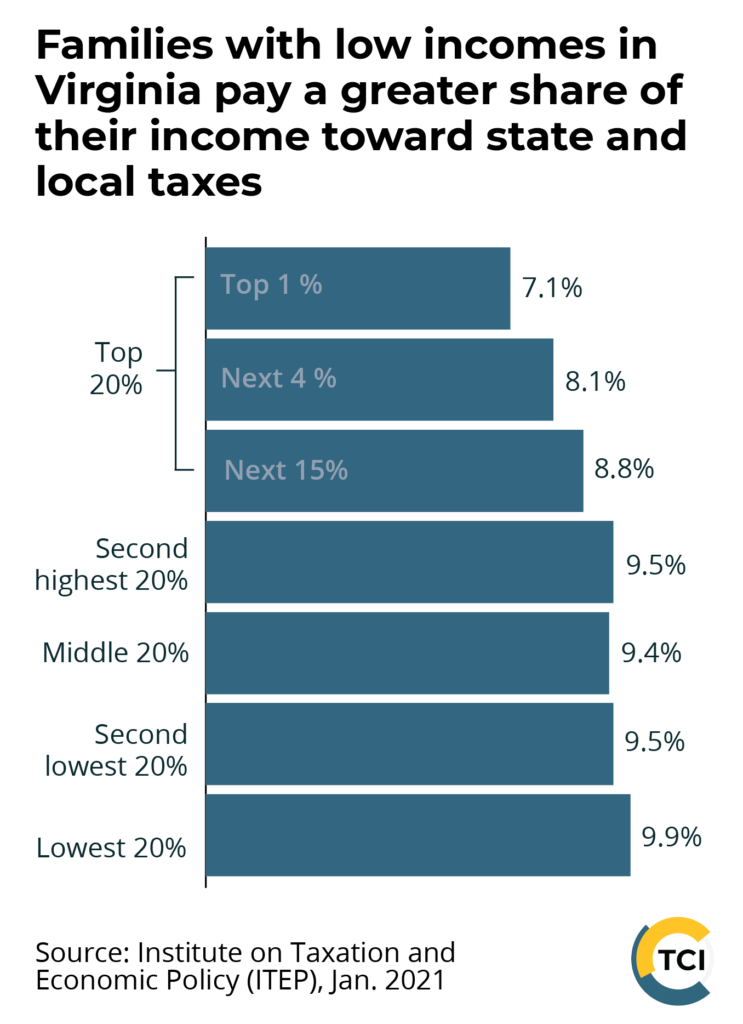

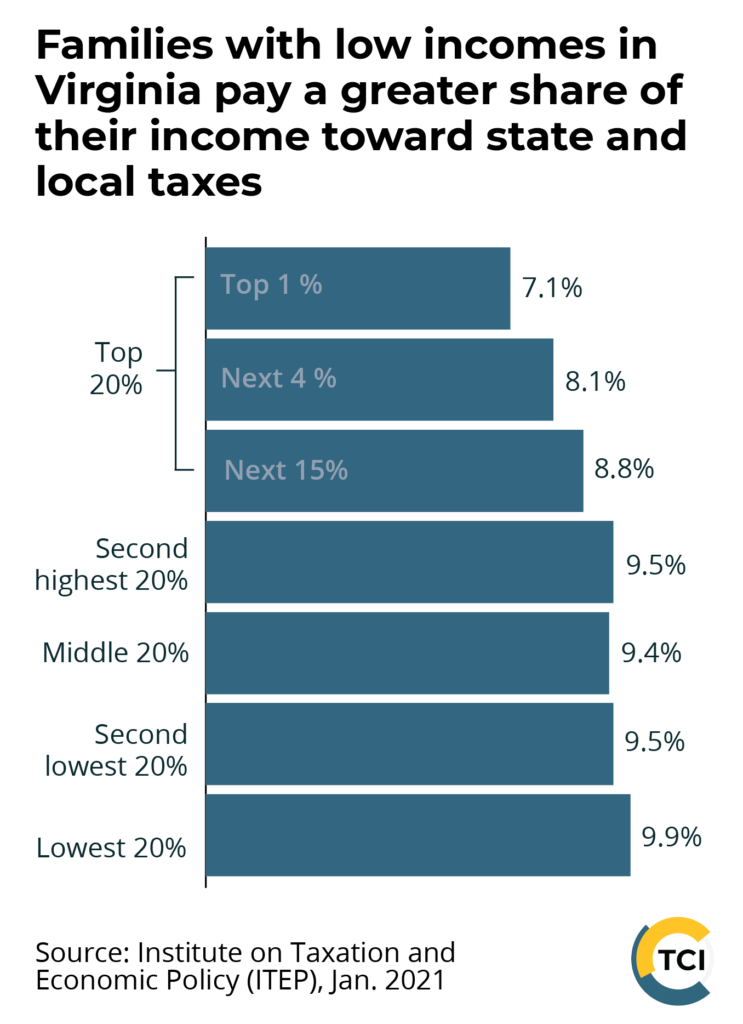

Tax Policy In Virginia The Commonwealth Institute The Commonwealth Institute

Look Up Pay Bills Town Of Arlington

The Real Deadline For Depositing 401 K Deferrals And What To Do If You Re Late Www Patriotsoftware Com Payroll Software Deposit Employment

Online Bill Payment Town Of Dartmouth Ma

Motor Vehicle Excise Information Methuen Ma

Have You Paid Your Excise Tax Bill Yet 2019 Motor Vehicle Excise Taxes Are Due On Saturday March 23 North Andover News

Digital Tax Stamp Businesses Must Comply With New Excise Tax Norm Digital Tax Consulting Business Chartered Accountant

Gst Migration Registration For Existing Assessee Registration Consent Letter Patent Registration

All About Gstr1 And Updates Income Tax Return Income Tax Professional Accounting

Top Benefits By The Best Gst And Income Tax Service Providers In 2022 Filing Taxes Online Taxes File Taxes Online

Tax Collector Frequently Asked Questions Town Of North Providence Rhode Island

Federal Excisetax Form2290 Quarterly Federal Excise Tax Form720 International Fueltax Agreement Report Ifta All These Tax Deadline Filing Taxes Tax